贝恩公司与消费者指数(Worldpanel)今日联合发布了《2025年中国购物者报告,系列一》,这是双方追踪中国快速消费品市场以来的第29份报告。

报告指出,近四年来,受“消费平替”趋势持续影响,中国快速消费品市场整体销售额增长放缓。回望2024年,国内外宏观经济环境复杂多变,中国快速消费品市场的整体销售额实现0.8%的增长,其中销量增长4.4%,但平均售价下降3.4%。分季度来看,2024年一季度和二季度的销售额分别增长1.5%和1.8%,三季度下降0.6%,四季度增长0.4%,实现轻微反弹。

最新数据显示,2025年一季度,中国快速消费品市场的整体销售额同比增长2.7%,延续了去年的增长态势。增长的动力主要来自于部分宏观经济指标的改善,政府多项提振消费政策激发的消费活力,以及春节期间消费的强劲增长。

贝恩公司资深全球合伙人、大中华区消费品业务主席邓旻表示:“2024年中国快速消费品市场呈现出明显的‘消费平替’趋势,我们看到平均售价的降幅为过去四年之最。此外,受人口老龄化和人口迁移等因素的影响,三四线城市的消费增速超过一二线城市,而2020-2023年还是二线城市在引领市场增长,因此,我们看到中国新线城市蕴藏了巨大的消费新增量。”

家庭护理类目继续引领增长

报告指出,受健康和卫生需求推动,家庭护理类目继2023年取得强劲表现之后,在2024年销售额实现2.4%的同比增长,继续领跑快速消费品市场。包装食品和饮料类目紧随其后,销售额分别同比增长2.0%和1.5%。

个人护理类目延续下滑态势,降幅达到2.3%。近年来,医美行业竞争力不断提升,对护肤品和彩妆市场带来了一定冲击。婴儿纸尿裤销售额也因出生人口减少出现下滑。相比之下,牙膏在能够满足消费者需求的高端产品的推动下,成为个人护理类目中的唯一增长的品类。

2025年一季度,家庭护理、个人护理和包装食品类目均实现销售额增长,饮料类目则相对平缓。值得一提的是,个人护理类目销量大幅增长,推动销售额同比增长4.0%,停止了持续下滑的态势。在其他三大类目中,家庭护理类目销售额增长6.1%,增速最快,包装食品类目增长3.2% ,饮料类目增幅仅0.5%。

电商和超市/小超市渠道依然占据主导地位

2024年,中国快速消费品市场电商和线下渠道整体占比基本保持稳定,但内部格局均出现变化。在线下渠道中,杂货店和超市/小超市(包括增长迅速的折扣店)渠道的表现优于市场整体。这两大渠道的增长动力主要源于三、四线城市,随着城镇化进程加快,这些城市的消费需求不断攀升。此外,在上线城市,仓储会员店依旧保持着增长速度。

在电商平台中,抖音保持快速增长,继续扩大市场份额,而其他平台的发展则趋于平缓。2024年食品和非食品品类之间出现了明显的两极分化发展趋势:非食品品类的电商渗透率进一步提升。反观食品品类,由于食品安全风险较高,消费者更倾向于线下选购,使得其电商渗透率出现下滑。此外,报告还指出,电商渠道聚集的小品牌数量较多,凭借价格优势占据市场,尤其是在个人护理和家庭护理两大类目中更为显著。这也导致两大类目平均售价降幅比包装食品和饮料类目的降幅更为显著。

即时零售O2O渠道在2023年增速明显放缓,2024年则呈现明显下降态势,快速消费品销售额下降10.0%。按平台类型来看,社区团购平台和综合性平台降幅明显,而垂直类电商取得较快增长。其中,社区团购平台的主要增长动力源自其价格优势。但随着折扣店和其他新兴业态的崛起,社区团购平台面临的市场竞争越发激烈。垂直类电商则在2024年实现了26.0%的增长,表现出色。

消费者指数中国区总经理李嵘指出:“疫情过后,配送稳定、准时的企业更受消费者认可。头部企业通过拓展业务布局、丰富商品品类、推出自有品牌等策略,有效提升了利润空间。此外,中国消费者平均每年会通过7种以上的渠道购买快速消费品。这意味着所有中国消费者都可视为全渠道消费者。在中国市场,为满足消费者核心需求,电商与线下渠道不断迭代创新。对消费者而言,性价比与便利性是选择购物渠道的关键因素。”

2024年新锐品牌和本土品牌表现优于整体市场

2024年品牌间的竞争态势依然白热化,有超过半数品类的前五品牌丢失市场份额。在果汁、冲泡咖啡、面巾纸、营养保健品、即饮茶等品类中,新锐品牌通过强化产品健康属性和持续创新,不断蚕食传统品牌的市场份额,成为推动品类增长的主力军。

此外,在报告追踪的27个品类中,有将近一半的品类出现本土品牌抢占外资品牌市场份额的局面。实际上,自2012年报告开始追踪本土和外资品牌市场份额变化趋势以来,本土品牌始终表现出色,不断抢占外资品牌市场。到2024年,本土品牌整体市场份额已攀升至76%。

“消费平替”趋势延续,但聚焦创新、精准满足消费者特定需求的高端产品发展同样良好

2024年及2025年一季度,影响家庭总支出的最大因素在于产品选择。在包装食品、饮料、家庭护理和个人护理四大类目中,消费者都在积极寻找更经济实惠的产品来替代常买的产品,从而能够提升购买量,“消费平替” 趋势愈发凸显。

高端果汁、冲泡咖啡、牙膏和卫生巾凭借产品创新和升级,取得超过品类整体市场的增速。其中,得益于消费者对健康营养饮料需求的持续增长,果汁实现量价齐升。冲泡咖啡平均售价也实现可观增长,主要是因为消费者对更高品质的精品冲泡咖啡需求日益增长。牙膏则因为平均售价较高的美白牙膏爆火,在2023至2024年取得了相对较高的平均售价增幅。在卫生巾领域,年轻女性对经期健康了解程度加深,推动各品牌积极投资产品升级,助力高端产品实现增长。

高端面巾纸、瓶装水、个人清洁用品、彩妆、洗发水、护肤品、酸奶和护发素的销售额均出现下滑。主要是因为在“消费平替”趋势的影响下,白牌和自有品牌崛起,凭借可靠品质和价格优势赢得消费者青睐,抢占高端产品销售额。

贝恩公司资深全球合伙人布鲁诺(Bruno Lannes)表示:“2025年,中国快速消费品市场依然面临一定的价格挑战。当前,相比整体市场而言,高端市场出现下滑,品牌是选择专攻高端市场,还是参与大众市场的竞争,亦或是双管齐下、同时布局,这是品牌商必须做出的战略抉择。”

品牌商可利用31个价值要素与消费者产生共鸣

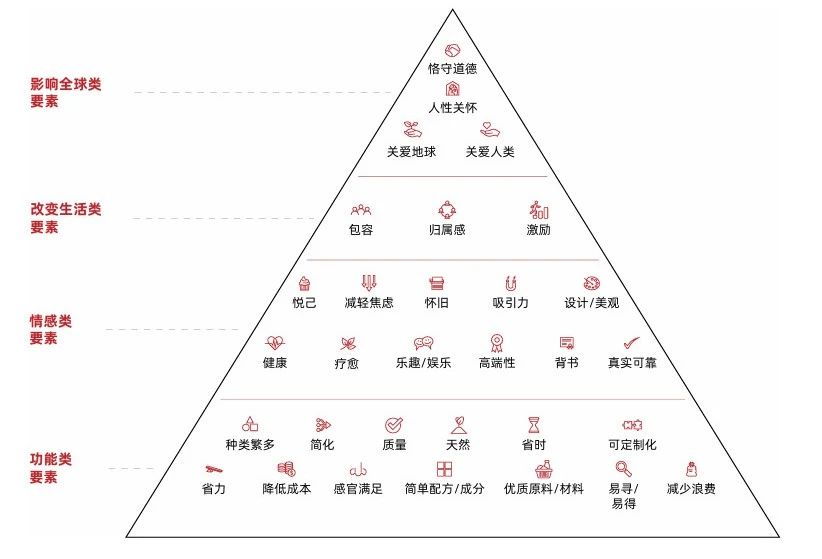

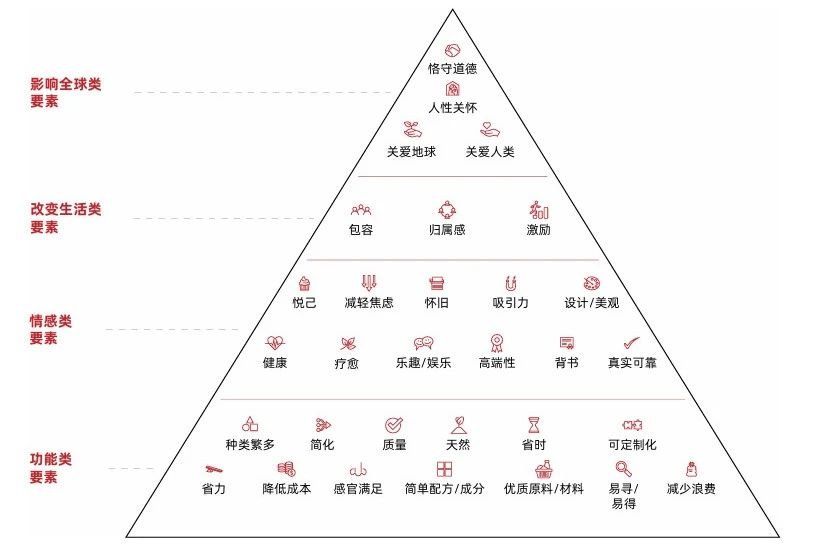

布鲁诺提到,在贝恩公司的经典方法论“价值要素金字塔”(Elements of Value®)体系中,我们通过衡量消费者对于价值属性的认知,将31个价值要素分为四大类别:功能类要素、情感类要素、改变生活类要素、影响全球类要素。他建议,在当前的“消费平替”趋势下,品牌商要更加深入、全面地了解消费者不同的价值需求,进行自我评估,判断自己应当为消费者提供哪些价值要素,同时明确应当布局哪个价位的市场。

点击下方报告名称或右上角PDF按钮下载

English Version:《China Shopper Report 2025,vol.1》

For the fourth year running, price deflation continues to plague China's fast moving consumer goods (FMCG) sector, resulting in slower value growth overall, according to the 14th China Shopper Report 2025 Vol. 1 released today by Bain & Company and Worldpanel.

Despite challenging macroeconomic conditions in 2024, the sector saw a 0.8% annual value growth, which was supported by strong volume growth of 4.4%, but dragged down by a 3.4% decline in average selling prices (ASP).

Looking at the respective quarters in 2024, China’s FMCG grew at 1.5% in Q1, 1.8% in Q2, -0.6% in Q3, and a small rebound to 0.4% in Q4. The first quarter of 2025 continued the growth momentum as value grew 2.7% compared to the previous corresponding quarter, as some macroeconomic indicators improved, and the government announced policies to support domestic consumption. Additionally, the quarter was supported by strong spending during the Chinese New Year season.

“The price deflationary trend was notable in 2024; it dropped 3.4%—the biggest ASP drop over the past four years,” said Derek Deng, head of Bain & Company’s Greater China Consumer Products practice. “Another interesting trend we saw last year, was how aging population and resident outflows from higher-tiered cities, drove material value growth in Tier 3 and 4 cities, which significantly outperformed the higher-tiered cities. This is in contrast with 2020-2023 trends, where Tier 2 cities led FMCG growth.”

Home care continues to lead growth

In 2024, home care continued to lead FMCG growth, expanding by 2.4% annually after a robust performance in 2023, driven by health and hygiene needs. Packaged food and beverage followed, with annual growth at 2.0% and 1.5%, respectively.

Personal care continued a downward trend, dropping 2.3%. Medical cosmetology has become an increasingly competitive alternative over the past few years, affecting skincare and makeup consumption, while lower birth rate caused declining diaper sales. Toothpaste was the only category that bucked the trend as consumers saw premium options that met their needs.

In Q1 2025, the home care, personal care, and packaged food categories increased value, while beverage growth stagnated. Interestingly, personal care reversed its downward trend with a significant year-on-year value growth of 4.0% due to significant volume increase. Home care maintained the top position in value growth (+6.1%), packaged food also saw robust value rise (+3.2%), while beverage grew a slight 0.5%.

E-commerce and super/mini channel mix continued to dominate

In 2024, the overall online and offline channel mix for China’s FMCG market remained stable. However, many changes took place within the offline and online channels respectively. Within offline channels, the grocery and super/mini (which includes fast growing discount store) formats outperformed the market primarily in Tier 3 and Tier 4 cities, where urbanization increased demand. In higher-tiered cities, club warehouses continued their growth trajectory.

Online, Douyin maintained rapid growth and share gain, while other players were relatively stagnant. 2024 saw a clear polarization between two major categories: non-food and food. Online penetration continued to grow in non-food categories while food products, which are more prone to safety issues, were mostly purchased offline. Online channels also featured more small brands and cheaper prices, especially in the personal care and home care categories, which may explain the larger ASP declines in these categories vs. food and beverage categories.

Online-to-offline (O2O) growth slowed significantly in 2023 and continued a clear downward trend in 2024, dropping 10.0% across all FMCG categories. Across platforms, community group buying, and horizontal marketplaces declined drastically, while vertical e-commerce platforms experienced faster growth. Community group buying has been driven by price advantages but is now facing intense competition from discount stores and other formats. Vertical grocery e-commerce was a standout performer, growing 26.0% in 2024.

“Post-Covid, consumers have embraced online grocers with reliable, on-time delivery. Leading platforms expanded while optimizing profitability through initiatives like category diversification and private-label offerings,” said Rachel Lee, General Manager of Worldpanel in China.

“On average, Chinese consumers purchase from more than seven different channel types in a year. Virtually, all Chinese consumers can be considered omnichannel consumers. Both online and offline channels are continuously evolving into new formats to meet consumers' core needs. Value and convenience are the key drivers behind each channel choice.”

Both insurgent and domestic brands outperformed the market in 2024

Brand competition was still intense in 2024, with the top five brands losing share in more than half of FMCG categories.

In emerging categories such as juice, instant coffee, facial tissue, nutrition supplements, and ready-to-drink tea, growth was mainly driven by insurgent brands focused on healthy attributes and innovations that won market shares away from traditional brands.

In emerging categories such as juice, instant coffee, facial tissue, nutrition supplements, and ready-to-drink tea, growth was mainly driven by insurgent brands focused on healthy attributes and innovations that won market shares away from traditional brands.

Domestic brands gained share from foreign brands on an aggregate basis in nearly half of the 27 categories tracked. Since 2012 (when the report started to track this trend), domestic brands have demonstrated a strong and steady ability to gain share from foreign brands on an aggregate basis—claiming 76% of the market in 2024.

Consumers trading down while premium segments thrived in categories that innovate and cater to specific needs

The biggest driver affecting total household spending in 2024 and in Q1 2025 was product choice as consumers were able to increase volume by seeking more affordable alternatives to products they used to purchase. Downtrading was consistent across all four major categories.

In four sub-categories - juice, instant coffee, toothpaste, and sanitary pads - the premium segment outgrew the market overall, driven by innovations and product upgrades. Juice witnessed both volume and ASP growth because of increased demand for healthy and nutritious beverages. The instant coffee category also experienced substantial growth in ASP, matching consumers’ increasing demand for more sophisticated, high-quality instant coffee. Toothpaste also had a relatively high ASP growth rate from 2023 to 2024 due to growth in the whitening segment, which has a higher ASP. Sanitary pads also saw growth in the premium segment, as brands are investing in product upgrades as young women become more educated about menstrual health.

The premium segment declined in value for facial tissue, packaged water, personal wash, makeup, shampoo, skincare, yogurt, and hair conditioner, as consumers primarily shifted to white-label and private-label brands as credible alternatives.

“The 2025 pricing environment continues to be challenging. Brands will face a strategic choice: specialize in the premium segment, even if it is declining relative to the overall market, or determine how to compete in the mass/mainstream segments, or compete in both,” said Bruno Lannes, a senior partner at Bain & Company’s Consumer Products and Retail practices.

There are 31 elements of value that brands leverage to connect with consumers

To succeed in the current trading down environment, the report suggests using Bain’s Elements of Value® framework which measures consumers’ perceptions of 31 attributes across four categories: functional, emotional, life-changing, and global impact. Brands should assess which value they are delivering to consumers and the price segments they should compete in.

微博

微博 微信

微信