By Serge Hoffmann, Bruno Lannes, Weiwen Han and Jessica Dai

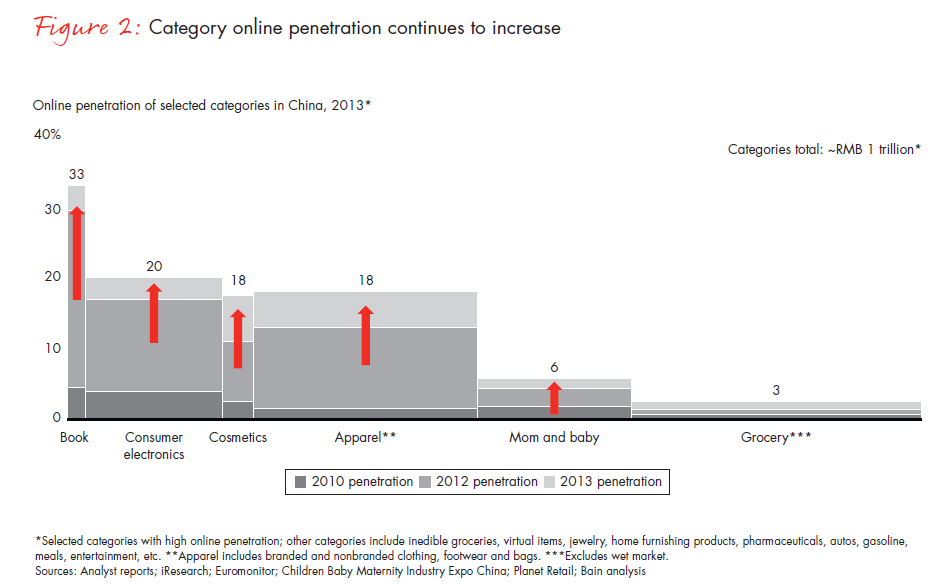

In the world of digital retailing, all eyes are on China. Even as overall retail sales growth slows, along with the rest of China's economy, online sales in the world's largest digital marketplace continue to boom, growing at an annual rate of 25% (see Figure 1). Based on Bain & Company analysis, B2C online retail in China will grow three times faster than overall retail, By 2018 half of total online sales will come from Tier-3 cities and below. Penetration continues to increase for online shopping's core categories. For example, consumer electronics registered a 20% penetration rate, and the penetration rate for apparel rose to 18%. In groceries, one of the fastestgrowing categories, penetration is now at 3% (see Figure 2). All of this is supported by a population that eagerly embraces online commerce and a leading-edge, cost-effective infrastructure for payments and delivery.

.png)

To understand the dimensions of this booming business, consider the rapid expansion of the infrastructure that is smoothing the flow of e-commerce and steadily making it a more viable alternative to traditional retail channels. The country's third-party online payment systems are sophisticated by any standards, and they have flourished in part because of their convenience. The total transaction value for third-party platform Alipay alone reached more than RMB 3.5 trillion in 2013. That's triple the total value of everything transacted on PayPal, the global system that encompasses far more than retail payments.

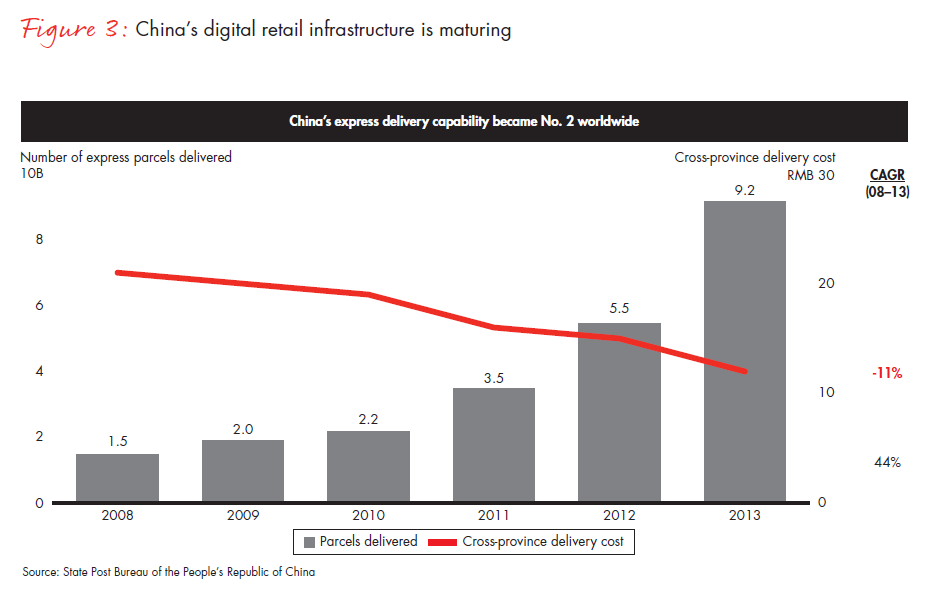

Meanwhile, China's logistics system has advanced with similar drama. Last year, 9.2 billion parcels were delivered by express companies (see Figure 3), with six large, branded shipping companies each distributing more than 1 million packages a day. Economies of scale have helped these logistics companies cut the cost of deliveries by about half. And thanks to heavy investment by logistics players, a retailer now can deliver merchandise to the majority of cities in Tier 1–3 within two days and to the rest of the country within four days.

The last mile is always the trickiest, and Chinese companies have devised innovations that solve that problem, furthering their reach and lowering their cost. Taobao, for example, entered into a strategic agreement with China Post to use its outlet collection and distribution centers. For its part, JD.com has innovated a host of pickup options: machines, pickup vans, community centers, convenience stores and bus stations.

As this infrastructure evolves so do China's consumers. To understand how customer behavior is changing, and what this means for retailers and brands, Bain & Company partnered with Chinese e-commerce consumer data technology company AdMaster. Our analysis and insights are helping domestic players and multinationals outpace rivals in the digital world.

Among the most important trends to emerge, the vast consumer market that so heartily adapted to online shopping is just as enthusiastically making the leap to mobile retail. Last year China became the world's largest online marketplace; next year it may lead the world in mobile commerce sales. Our analysis found that fully 80% of Chinese consumers who bought online last year made at least one purchase from a smartphone; 20% are weekly mobile shoppers. That's why companies like Suning and Walmart have invested to offer mobile apps that make it easy for customers to browse and purchase from their phones.

The highly promoted 24-hour period during which online retailers heavily discount their wares, called Singles' Day and celebrated on 11-11 (November 11), continues to set new records for sales. This year's event brought $9.3 billion in sales for e-commerce leader Alibaba Group. In addition to breaking records, this most important day of the Chinese retail year reflected the changing nature of digital retail: While the value of overall transactions grew 60% from last year, the value of mobile transactions rose by around 300%. And 2014 became the year of significant overseas expansion for China's e-commerce platform, attracting buyers and sellers from about 200 countries. Another big advance this year: Singles' Day drew participation from social media sites, like Youku and Weibo, to convince shoppers to take advantage of sales in physical stores and restaurants—signaling the potential for online-to-offline (O2O) commerce.

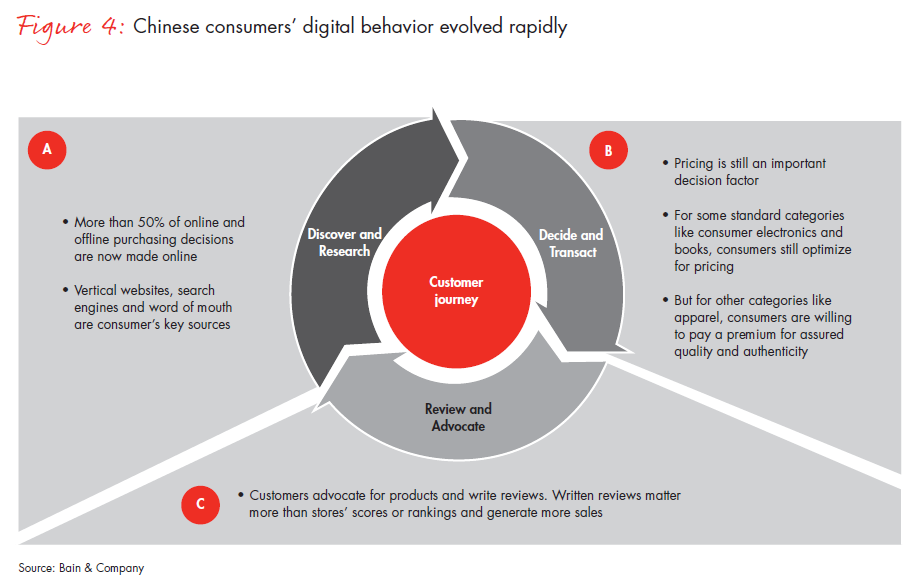

Retailers and brands are discovering that winning requires a broad view of customer engagement and consumer data. Simply put, it's more than just the transaction. Increasingly,the transactions themselves are becoming just a single step in an online consumer journey enabled by digital capabilities (see Figure 4). That journey begins when a customer goes online to discover and research products. It continues when the customer decides to purchase and makes the transaction. Then, in surprisingly large numbers, China's shoppers go back online after a purchase to share their experiences. Satisfied customers advocate for brands and retailers; dissatisfied customers discourage others from making similar purchases. As China's e-commerce market evolves, the most successful retailers and brands will be those that invest to engage with customers at all three stages of this journey.

Understanding the digital journey

Let's look at each of these stages.

Discover and Research. China's online consumers don't shop blindly. In a continuation of a trend reported last year, more than half of all customers now consult online sources, such as vertical websites, online forums and search engines before making a purchase decision—regardless of whether they buy online or in a physical store.

As in the physical world, digital shoppers in China are not easily convinced to buy. That's why they spend so much time browsing. And there's an abundance of places for them to browse online. Their preference for comparing products is also the reason that shoppers in China rely so heavily on online reviews—the more detailed the review, the better. In fact, while shoppers have relatively little regard for scored ratings—either on a retailer's website or a third-party site—Chinese consumers are highly influenced by written comments posted by other consumers. Our analysis of online store performance shows a strong correlation in some product categories between online written reviews and sales: The more online reviews, the higher the sales. In addition to the increased dependence on online reviews, consumers are also more influenced by word-of-mouth endorsements from family and friends.

Since customers value other customers' opinions over official company messages, the lesson for brands and retailers is clear: Social media now outweighs traditional advertising.

Decide and Transact. The second step in the digital journey involves the decision to buy and make the transaction. Price has always been important to Chinese shoppers, and there's no better evidence of this than the phenomenal popularity of Singles' Day discounts. Price comparison, which is much easier in the online world than in physical stores, is a key activity before online purchases. Price remains the primary consideration in categories like books and consumer electronics, according to the observation of Kung Fu Data, an e-commerce data analytics firm. But in some categories, price is not the most important consideration. In apparel and cosmetics, for example, the online store with the lowest price doesn't always get the sales. Based on Kung Fu Data's observation, stores offering assurance in quality and authenticity can capture more sales, even with higher prices.

Review and Advocate. As we’ve mentioned, online customers—whether they’re satisfied or unhappy with a product—increasingly like to share their experiences online. The popularity of online reviewing in China is impressive: Nearly 80% of customers surveyed gave digital reviews following purchases last year, either in the form of scores or the more prevalent written comments, and mobile shoppers were more engaged in reviewing product details than PC shoppers. Reviews boost sales. That's why winning retailers and brands encourage feedback, particularly the written reviews that online shoppers find so valuable. Some, like Taobao, offer a rewards program for customers who write detailed reviews. It's a cost-effective way of generating sales. Companies also boost the odds of getting favorable reviews by investing to make the customer experience enjoyable. Bain's research in customer loyalty determined that not only do satisfied customers spend more and make future purchases, they also tell their friends.

China's e-commerce ecosystem

Alongside the customer's online journey, an ecosystem has emerged, dominated by the mega-players in digital media, e-commerce platforms and social media. As they pursue growth in the digital retail marketplace, brands and retailers that understand the ecosystem's continuing evolution, and how best to use it, will maximize their return on investment. That means keeping abreast of the opportunities offered not only by established companies but also by smaller ones entering the field.

Alibaba, Baidu and Tencent—the triumvirate that built up the ecosystem—will maintain their positions, generating traffic for brands and retailers as well as enabling transactions and customer engagement. In fact, they’re expanding their roles. However, even as these major companies grow, new entrants are gaining ground with innovative services. A single example: the success of Shangpin, a site that specializes in full-priced, high-end fashion and luxury brands. Consumers like the site because it provides only curated products, offers in-house fashion advice and even delivers such value-added services as free dry cleaning, shipping and returns. Ardent users reward the site with a high repurchase rate: 75% of its sales are from return customers.

As in most rapidly growing industries, however, it's the mega-players who are reaping the profits—something that will remain elusive to many of the newcomers. The reality is that a large percentage of the younger companies, even those with a solid business model, will lose in the race to achieve scale before their funding runs out. China's e-commerce market has become that competitive.

The Discover and Research step of the customer journey is enabled by the lead builders, companies that grew the scale to direct Web traffic to whoever pays them. Baidu and Tencent will remain the two major players in this area. Both are aggressively expanding their reach to capture more of the opportunity, though from different angles. Baidu is the biggest search engine and Tencent, the biggest social media player. Both are rapidly acquiring an array of Web portals, video sites and vertical sites—platforms that will allow them to build brand awareness and create sales leads online.

Meanwhile, alternative lead generation companies are gaining traction. These include online video portal LeTV.com, which offers online video programs and movies, and Sohu.com, which provides search, gaming and other online services. This expands the opportunity for brands and retailers to generate leads by splitting their advertising spending among a list of selected websites and platforms.

When it comes to the Decide and Transact stage of the customer journey, there's no doubt that Tmall and its competitor JD.com will remain the two major companies in e-transactions. However, vertical and customer-segment platforms are becoming increasingly relevant, introducing new ways to address consumers' and brands' unmet needs. Consider VIP.com, a vertical marketplace targeted to female customers in lower-tiered cities. With more than 7 million active users as of early 2014, the site is growing its user base at an annual rate of 170%. Two years ago about 1,000 brands were represented on VIP.com—now it has around 7,000 brands.

Curated customer-segment sites are also surfacing as an attractive option for e-commerce customers and the brands or retailers that hope to reach them. Meilishuo.com, for example, is one of the new crop of fashion-focused social media sites that, like Pinterest, enable users to share photos of jewelry, apparel and other items with friends.

A variety of food sites highlight the range of opportunities for brands and retailers. SF Best, developed by one of China's top delivery services, specializes in imported, high-end food and beverages, and benefits from the company's existing distribution network. Womai.com was established by COFCO, China's largest supplier of agricultural products and services in the food industry. It offers food from COFCO's own brand, as well as from other domestic and imported brands. Benlai.com, a more narrowly focused site, appeals to consumers looking for fresh produce and healthy food.

The home furnishings segment is also blossoming. Established in 2005, Qijia.com, one of the segment's largest sites, represents a range of furnishing suppliers. It provides customers with professional furnishing consultations and oversees after-sales services. For its part, MMall.com—operated by Macalline, one of China's biggest home furnishing companies—sells online and in its more than 100 physical stores, providing business-to-business-to-consumer (B2B2C) and business-to-consumer (B2C) and group buying services.

Brands and retailers have two major options for Review and Advocate, the third stage of the customer journey: messaging apps WeChat and Weibo. Many find Weibo better suited for rapidly spreading information to a large population of existing and prospective customers; the service makes it easy to use opinion leaders to create buzz for a product or to forward a positive message to tens of thousands of users.

Meanwhile, Tencent's WeChat, the largest standalone messaging app, based on monthly active users, allows retailers and brand owners to interactively engage with loyal customers and promoters among WeChat's 600 million registered users. Brands and retailers regularly post new information and answer questions on public accounts. By engaging with followers who express interest, they can develop and retain promoters. Just as important, the platform gives brands and retailers the capability to analyze customer behavior and enable even more targeted marketing.

How to win? The road ahead for brands and retailers

What do these shopper trends and this evolving ecosystem mean for companies hoping to succeed in China's e-commerce marketplace? Our analysis of digital retail behavior and the expanding digital ecosystem points to a fundamental implication: An innovative digital strategy is no longer optional; it's absolutely essential. Chinese consumers' passion for online shopping will only continue to grow, and online sales will continue to outpace offline sales.

The dynamic world of Chinese e-commerce is no place for the risk-averse among brands and retailers. In our view, it's more important for a company to establish itself as a player with a working prototype that can be improved over time than to sit on the sidelines and wait for the perfect solution. The best companies will rely on partners with the skills to help them quickly get in the game; most traditional brands and retailers lack the required capabilities within their own organizations. They’ll also take a “software release” approach to their offering, starting out small, if necessary, but with the ability to continually innovate with new releases.

Again, the best brands and retailers will use the customer journey as their guide. They’ll design marketing innovations that redefine the Discover and Research stage, omnichannel distribution innovations that better enable Decide and Transact, and customer relationship management (CRM) solutions that spur Review and Advocate for repeat purchases.

In the course of our work we’ve identified companies that are making big strides or important experiments in at least one step of the journey, disrupting a current business model with digital innovations that make the most of customer data.

Gaining an edge with Discovery and Research

We find that many companies overspend and still fail to reach their targeted customers. Haier, however, serves as a pioneer of targeted digital marketing excellence. It maintains a single database with customer data from all business processes and departments, and regularly updates the data—some of it in real time. For example, when a customer—let's call him Mr. Chen—visits a news site like NetEase, Ad Exchange (a service that allows brands and retailers to post ads at the right moment to accurately targeted customers) instantly alerts Haier to the opportunity to display an ad to Mr. Chen while he's on the site. At the same moment, Haier retrieves information about Mr. Chen from its own database, confirming that his purchasing behavior identifies him as a target customer. Then, Haier electronically bids to place the online ad.

Or look at Coca-Cola's success with its bottle nickname promotion. The beverage company invested in a system that allows customers to order bottles of Coke with personalized labels, on Yihaodian. After ordering, customers could share photos of their personalized bottles with friends via Sina Weibo and other social platforms, and Coca-Cola tracked the social network traffic for marketing potential. The effort yielded significant results: At the peak of activity, customers logged in to order 900 personalized labels within a single five-minute period. The program also increased Coca-Cola's active Weibo fans, from 5,000 to 150,000. And most important, more than 98% of surveyed users responded positively to the campaign.

Maximizing reach for Decide and Transact

Customers are well aware of the benefits of both online and offline channels: the ability to shop after hours and read reviews while shopping online, as well as the chance to feel, try on and easily return items to a physical store. They know when to shop online and when to visit the mall. However, many brands and retailers are less clear about the best channels for reaching customers to enable the Decide and Transact stage of their journey. In the physical world, a brand has three basic choices: selling from its own retail outlets, working with a distributor's affiliated retail network or selling via a traditional retailer. But the digital realm provides even more options—sometimes a perplexing array of options: a traditional retailer's digital channel, the brand's own e-commerce site, an e-commerce platform like Tmall or JD.com (and within those platforms, either flagship or merchant stores) or a curated e-commerce site.

.png)

Winners maximize their ability to reach customers by devising an omnichannel strategy, offering products through physical stores and online sites via computer as well as mobile devices like tablets and smartphones. The best companies create a seamless customer experience through consistent pricing and assortment. For example, casual-wear seller Uniqlo's integrated, multichannel approach sets the standard for harmonizing the online and offline retailing worlds. It attracts online shoppers by posting videos and ads on e-commerce platforms, targets ads on interactive media and launches marketing campaigns on social media platforms. The company delivers a consistent experience to both online and offline shoppers, selling the same SKUs at the same price point and, for the most part, with the same promotional activity. In this way, it benefits from both channels while avoiding the cannibalization that occurs when a lower-priced channel steals traffic from a higher-priced channel.

Closing the loop with Review and Advocate

We call it CRM 2.0: The best retailers are upending their CRM systems, designing interactive digital platforms that strengthen customer loyalty by better targeting products and services, and thereby promoting repeat purchases. With new digital capabilities, brands and retailers can manage data on a much larger scale and capture different types of data that transform how they sell, both online or offline. Just as a website offering can be instantly tailored to the customer viewing the screen, frontline salespeople in a brick-and-mortar store can be armed just as speedily with information that tells them how to customize their offering and how to interact differently with each customer.

Pediatric nutrition and baby care products provider Biostime is breaking new ground in its use of social CRM to interact with customers and to empower its front line. Biostime's CRM system makes use of its membership program participant data. Purchase data and customer information are immediately gathered and circulated throughout the system and then used to provide incentives to customers at every stage of the customer journey. For example, each time a member—let's call her Ms. Chang—makes a purchase, Biostime records the details of what she bought and when. Based on the data it collects, Biostime develops a customized marketing plan for Ms. Chang. It sends her an alert for repurchase three days before she is expected to finish a particular product, for instance. The payoff of this effort: Biostime achieved 50% annual growth in 2013, far above the category average, with the bulk of that growth coming from repeat customers.

That healthy growth is evidence that Biostime is on the right path for China's e-commerce marketplace in 2014 and exploring innovative possibilities outside the Decide and Transact stage. As online retail sales continue to outpace physical store sales and online retailing moves in new directions, winning brands and retailers will be those that treat the customer experience as a digital journey. Yes, it's important to provide a convenient way for customers to buy online. But it's just as important to outperform a competitor when it comes to delivering on customers' research needs, or to make it easy—even fun—for those customers to provide feedback. The most successful companies will not only serve customers throughout the journey, but will also use what they learn at each stage to continually innovate and disrupt their digital business models.

In such a dynamic market, companies that stand still will inevitably find themselves falling behind.

Serge Hoffmann is a partner in Bain & Company's Hong Kong office. Bruno Lannes and Weiwen Han are partners and Jessica Dai is a principal in Bain's Shanghai office.

微博

微博 微信

微信