At a Glance

•China's retail and consumption ecosystem has entered an era of restructuring. Brands must now compete across online, offline, and online-to-offline (O2O) channels.

•The balance of power is moving from brands and distributors to retailers and consumers, requiring brands to rethink how they deliver, differentiate, and grow.Consumer

•behavior is shifting around occasions, driving hyper-convenience and reshuffling category boundaries.

•Winning brands will build from the "CORE": by understanding the Circumstance, crafting the Offering, Routing it correctly, and Executing to win.

Authors

Joanna Lu,Senior Expert Partner Bain & Company

Bruno Lannes,Senior Partner Bain & Company

Steven Wang,Associate Partner Bain & Company

Fergie Chen,Manager Bain & Company

Why China's delivery wars need to be taken seriously

For senior leaders of consumer brands, China's ongoing delivery wars are a window into the future of global retail and make-or-break opportunity to secure a foothold in the world's second-largest consumer market. Here's why this moment demands urgent attention:

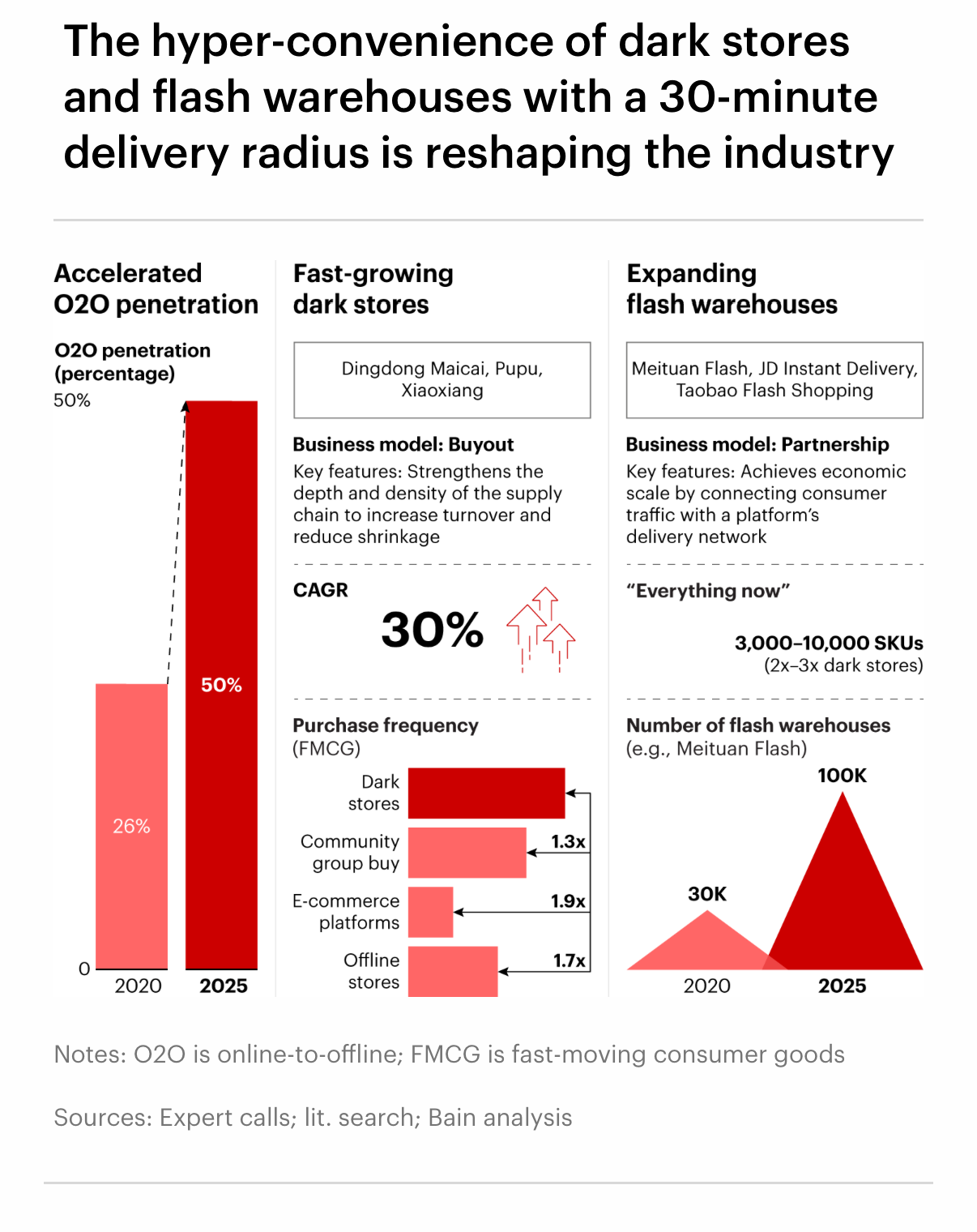

Online-to-offline (O2O) is now central to China's retail fabric: Post-2024, O2O average basket sizes jumped from about RMB 60 to RMB 90, expanding beyond emergency needs. Its penetration hit 50% (up from 26% in 2020), with dark stores seeing 1.7 times the purchase frequency of offline supermarkets. This isn't a niche—from fresh food to electronics, it's how 50% of Chinese shoppers now buy.

Platform competition is reshaping retail power: Meituan (美团), JD (京东), and Alibaba (阿里巴巴) have invested more than RMB 100 billion in O2O, breaking old duopolies and redrawing retail lines (on-site/offline to near-field/O2O to far-field/online). Even if they reduce subsidies in the future, which is likely, they control consumer journeys, merchant relationships, and fulfillment, replacing traditional distributors as the gatekeepers to shoppers. Brands will be locked out of high-growth channels if they ignore this trend.

Consumer habits have permanently shifted: The "night, lazy, rush, privacy, replenishment, fresh" (夜, 懒, 急,私, 补, 鲜) behaviors are now standard. Shoppers use O2O for late-night needs (replacing convenience stores), last-minute new products (e.g., JD's instant phone delivery, 京东手机秒送服务), and discreet purchases, meaning a brand's relevance now depends on meeting these micro-moments instead of simply having good products.

Distributors' route-to-market (RTM) models must change: Traditional distributors are losing influence, and retailers and third-party logistics providers (3PLs) now drive access. O2O demands occasion-specific packaging (e.g., small packs for replenishment) and differentiated SKUs, while demand generation channels (e.g., brand flagships) and sales conversion channels (e.g., O2O) require separate strategies. If brands stick to old RTM, they'll miss sales and loyalty.

The risk of falling behind is huge. China's retail is in "deep reshuffling"—discounters rise, retailers launch private labels (e.g., Sam's Club's Member's Mark), and local brands adapt faster. Delay adapting to O2O, and brands will cede a large group of Chinese consumers to competitors who prioritize their convenience.

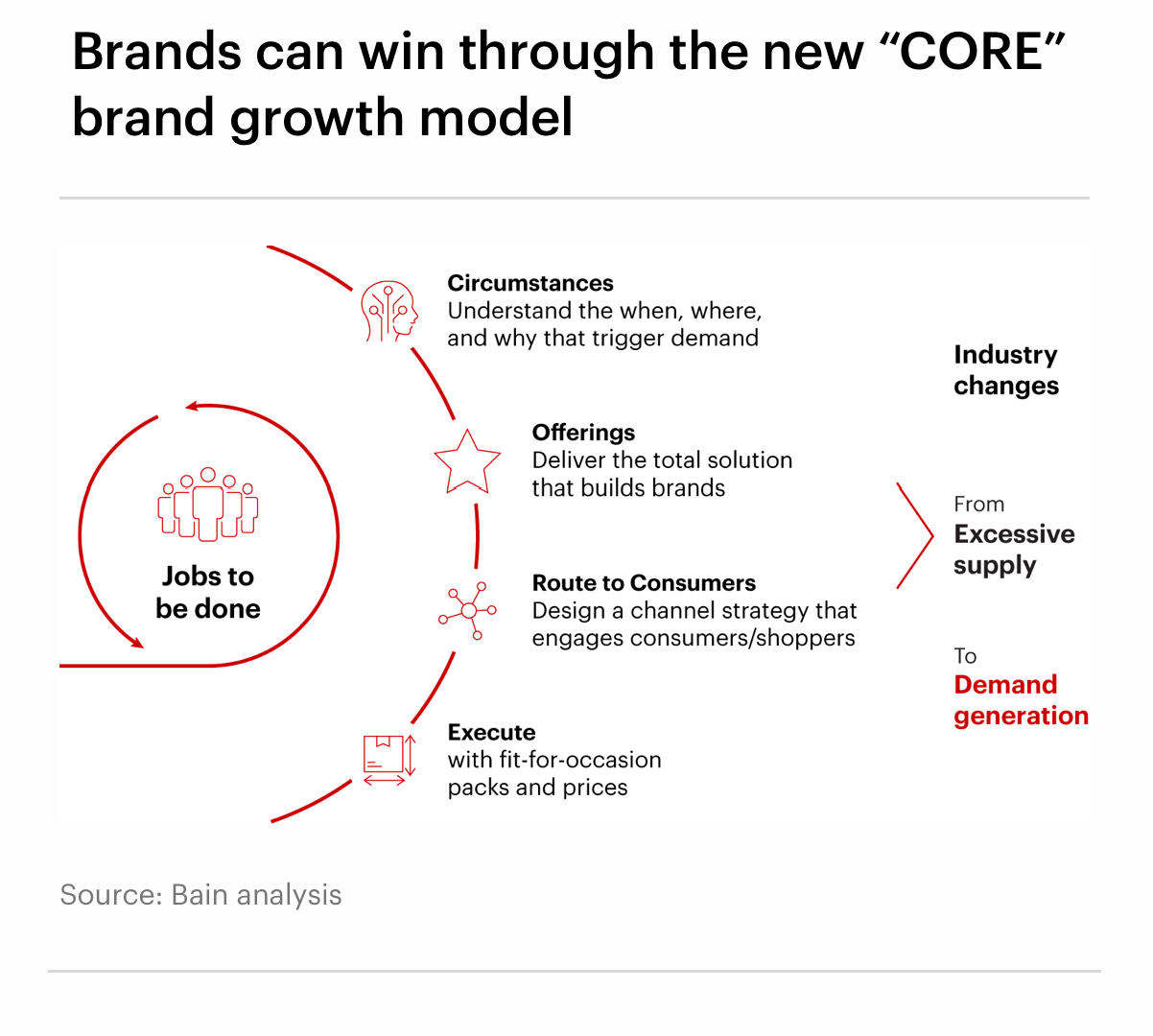

China's delivery wars define how consumers shop now and in the future. For global brands, leaning in is how they'll secure their future in this market. Brands will need to redefine their positioning, strategies, and go-to-market approaches, including how they form partnerships. To succeed, brands must use CORE as a new growth engine:

•C — Circumstances: Understand the when, where, and why. Use artificial intelligence (AI) to map the circumstances across consumer needs, occasions, and channel trends that trigger demand (emotional, social, and functional) for target consumers.

•O — Offerings: Deliver the total solution that builds brands. Combine brand, product, pack, price, and experience. Every offering should solve a consumer job-to-be-done in that circumstance.

•R — Route to Consumer: Design a channel strategy that engages consumers / shoppers. Design a channel strategy that ensures your offering is visible, accessible, and relevant—where the consumer naturally sees, engages, and buys. Think of route to consumer as the bridge between the brand and its audience.

•E — Execution: Execute with fit-for-occasion packs and prices. Deliver the offering through the right pack, price, and promotion—at the right time, in the right place. Execution turns strategy into reality and drives conversion at scale.

In addition, brands should enable digital and AI-driven capabilities. The model's success depends on AI and digital enablement across all components of the end-to-end growth model.

Understanding Chinese consumers post-Covid

Chinese consumers have changed significantly since the Covid-19 pandemic, with confidence falling sharply after spring 2022 and remaining low today.

This confidence decline stems largely from a negative "wealth effect" driven by falling real estate prices since their 2021 peak, oversupply in housing, and heavy debt among real estate developers. In response, Chinese households have increased their cash savings to compensate for the drop in property values. Youth unemployment, which reached nearly 19% as of August 2025, has further weighed on consumer confidence.

Facing these headwinds, Chinese households are:

•Managing budgets and looking for bargains, reinforcing the deflationary trends seen since 2021.

•Making trade-offs across the year and across categories and sectors.

•Seeking "true value," not the lowest price, by comparing price and value more rationally.

•Preferring experience spending, such as travel and tourism, outdoor activities, and pop concerts, while looking for affordable indulgences and emotional comfort.

•Looking for China relevance (not necessarily Chinese brands) in product design and features, or in the product's storytelling on social media.

•Focusing more on health, well-being, and quality of life.

Evolution of channels and the new O2O war

Beyond these broader trends, post-Covid consumer behavior has also shifted in how people use channels. Convenience e-commerce—often called quick commerce or O2O—gained traction during the pandemic for convenience, ease, and safety. Since 2024, it has grown even faster as the average basket size increased from about RMB 60 to RMB 90 and expanded to include products beyond immediate or emergency needs.

In earlier O2O models, traditional stores still played a role (and earned a share of the margin) because deliveries came from existing stores even when orders were placed online. This was economically viable when average basket sizes were small and delivery volumes manageable.

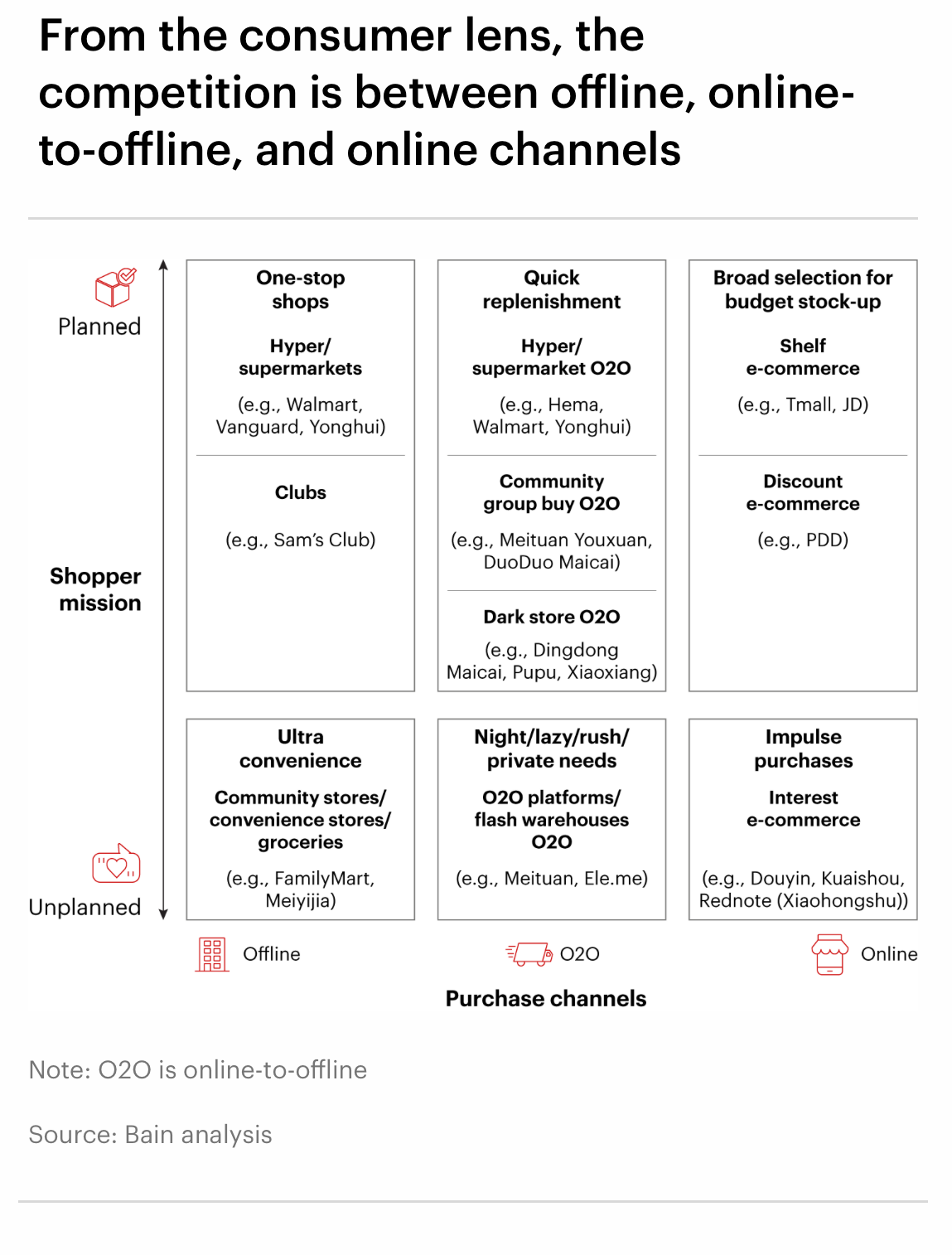

This O2O growth initially helped traditional retailers, even as they faced competition from newer retail models such as club warehouses, discount stores, and snack stores (see Figure 1).

Figure 1

In the past year, the O2O landscape has intensified. Meituan entered physical retail through its flash warehouse model, and in early 2025, JD made a high-profile move into food delivery, breaking the long-standing duopoly of Meituan and Ele.me (饿了么). Collectively, these three companies have invested more than RMB 100 billion in an O2O war. What started as a battle for food delivery subsidies is now driving a broader reconstruction of China's retail ecosystem centered on occasion-driven growth, even as subsidies become better controlled.

Each platform has distinct advantages. Meituan leads local commerce through its extensive fulfillment network, capitalizing on user habits and network advantages to dominate lifestyle services. Alibaba leverages a consumer traffic and mindset, using its "3Ps" framework (people, product, and place, 人-货-场) to reconfigure how consumers connect with brands. JD, built around a strong supply chain, focuses on product quality and fast, reliable fulfillment.

Competition among these platforms now plays out across three retail fields:

•On-site (offline, 现场): Traditional physical stores, where consumers have direct access to products.

•Near-field (O2O, 近场): The online-offline integrated O2O model that bridges physical retail and traditional e-commerce.

•Far-field (online, 远场): Pure e-commerce platforms that reach a broader consumer base.

The simultaneous entry of Meituan, JD, and Alibaba into food delivery reflects more than a fight for delivery orders. It's about controlling the front end of the consumer journey, owning relationships with physical merchants, and shaping consumer mindset. By expanding user coverage and enriching product categories, the platforms are challenging the on-site and far-field markets, effectively redrawing retail landscape.

Two new O2O models have recently scaled quickly and are now undergoing trials prior to full-scale rollout:

•Dark store model (前置仓): Led by Dingdong Maicai (叮咚买菜), Pupu (朴朴), and XiaoXiang (小象超市, a Meituan subsidiary), this integrated model delivers orders directly from the dark stores nationwide. They focus on specific consumer segments and are more occasion-driven, offering fewer SKUs than flash warehouses.

•Flash warehouse model (闪电仓): Operated by three major delivery platforms: Ele.me, Meituan, and JD. Brands sell to flash warehouse operators, often 3PLs, which then fulfill consumer orders from warehouses carrying up to tens of thousands of SKUs.

How has quick commerce reshaped consumer habits? Six core keywords capture the new habits: night, lazy, rush, privacy, replenishment, and fresh (夜, 懒, 急, 私, 补, 鲜):

•Night: Fulfillment of late-night needs. This scenario was previously dominated by convenience stores, but O2O models now better meet late-night ordering demands.

•Lazy: Cross-city gifting. For example, sending specialty foods or health supplements during the Mid-Autumn Festival, eliminating the need for in-person shopping.

•Rush: First-time access to new products. Consumers use JD's instant delivery service to be among the first to receive newly launched smartphones.

Privacy: Discreet purchase of personal items. A typical example is

the purchase of feminine hygiene products, where O2O delivery avoids potential

in-store awkwardness.

•Replenishment: On-demand restocking instead of hoarding.

Traditionally, consumers hoarded daily necessities from large retailers; now

they use O2O to replenish items as needed, reducing inventory waste.

•Fresh: Fresh food for outdoor activities. Consumers buy fresh food for camping via Meituan, which delivers the items directly to parks.

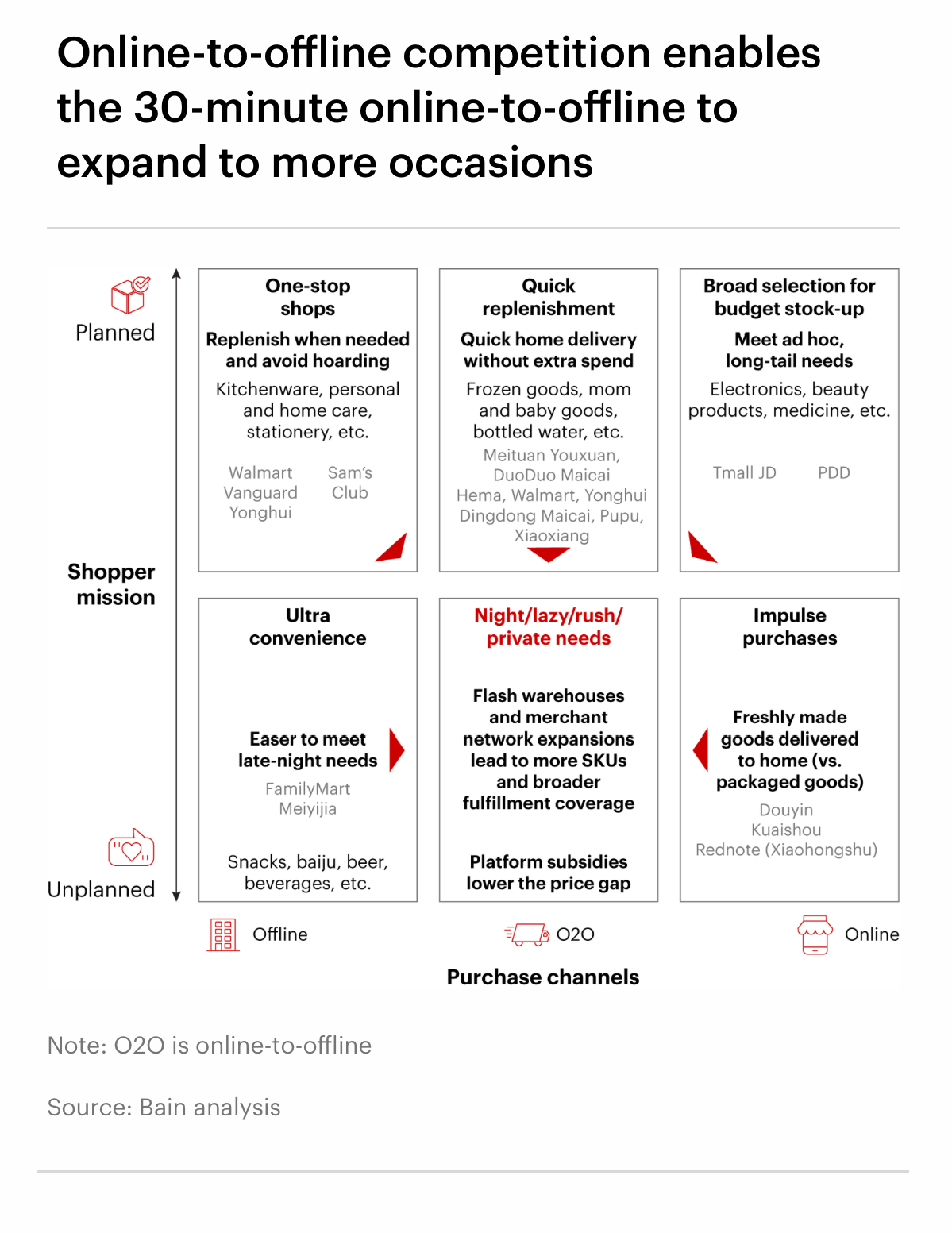

Against more traditional platforms and retailers, the two new O2O models are gaining market share across categories and occasions (see Figure 2).

Figure 2

This is the O2O of the future: from high-frequency, essential products to low-frequency, long-tail products (高频带低频,刚需带长尾).

In this new world, retail stores compete with food service stores, packaged consumer goods compete with dine-in food and beverages, consumers no longer hoard in bulk, in-store traffic shifts to online, and in-store categories face encroachment from food service. Since 2020, discounters have risen quickly in China, with flight-to-value trends observed across all consumer groups.

Over the past period, the retail industry has shifted from "selling shelf space" to "curating products," moving toward a new consumer-centric growth model. Meanwhile, four structural changes are taking place: hyper-convenience, downsizing, flight to value, and retailer as a brand (即时化,社区化,折扣化,品牌化).

Hyper-convenience

Consumers are adopting omnichannel shopping, and the ongoing food delivery wars are erasing traditional category boundaries. The penetration rate of instant retail has risen from 26% to 50% (see Figure 3). Among this, dark stores now record 1.7 times the purchase frequency of offline supermarkets. As supply chains become denser and more efficient, inventory turnover is rising and waste is falling.

Flash warehouses are using consumer traffic and delivery networks to build economies of scale for both businesses and end users. This creates hyper-convenience, where retail stores compete with restaurants, packaged goods compete with dine-in meals, and hoarding behavior continues to fade.

Downsizing

To meet growing demand for convenience, offline retailers are moving closer to communities and downsizing their store formats. The trend can be summarized as "shrink in big cities, expand in small cities." In higher-tier cities, demand for extreme convenience is fueling the rise of small community-based stores. In lower-tier cities, consumers still prefer large-format stores but expect access to higher-quality products.

Retailers such as Pang Donglai (胖东来) and Hema (盒马) proxy stores are popular in small cities. They offer one-stop shopping experiences while helping elevate product standards and consumption quality in lower-tier markets.

Flight to value

Consumers are seeking lower prices, driving the rise of discount formats and affordable alternatives. Today's consumers balance three priorities: social status (face), practical needs (substance), and rationality (sense). They want more cost-effective alternatives, making the flight-to-value trend prevalent across all consumer groups.

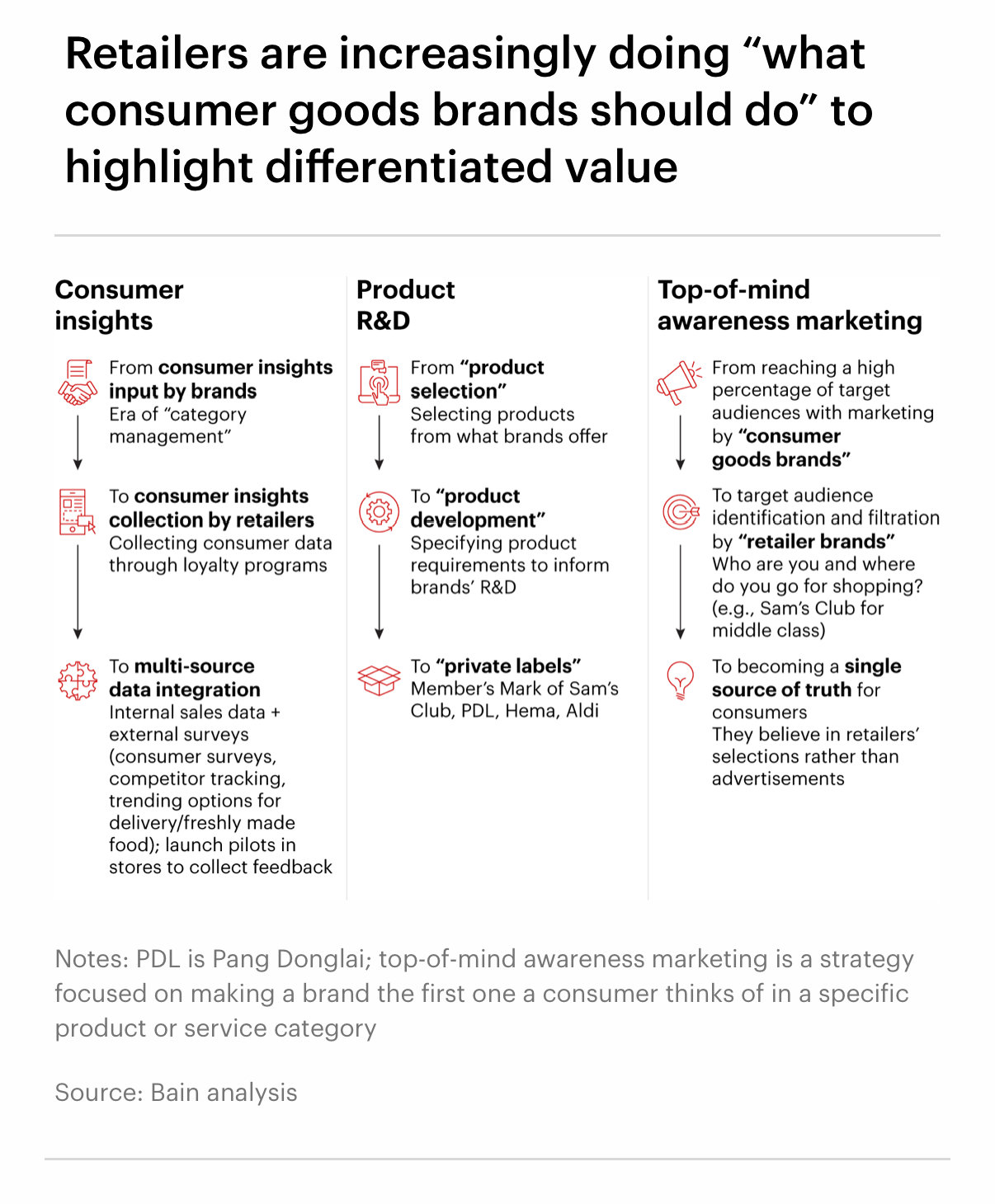

Retailer as a brand

To stand out in a crowded market, retailers are developing private labels and customized products. As the industry evolves, they are working to build differentiated value propositions that connect with their target audiences. Many are stepping into roles once held by consumer packaged goods brands, using consumer insights to guide product development and marketing (see Figure 4).

An increasing number of retailers have launched private labels, such as Pang Donglai Select, to strengthen brand identity and loyalty.

As a result, the upstream and downstream value chains are being reshaped. Brand owners are losing their bargaining power, and many traditional retailers risk being bypassed or forced to close.

China's retail market is thoroughly reshuffling. People, products, and places are being rematched based on evolving consumer perceptions. While there's no one-size-fits-all approach, new growth will be fueled by providing reliable delivery for fragmented needs.

Retailer as a brand

•Retailers are not driven only by the O2O revolution.

•Retailers now hold stronger consumer trust and greater digital capabilities. They manage their own customer relationship management (CRM) systems, conduct targeted surveys, and use advanced analytics to guide product development for partner brands.

•Many test and refine new ideas across multiple stores—Sam's Club (山姆会员商店), for example—using real-time feedback to optimize offerings.

•Retailers also benefit from high concentrations of consumers with similar needs, allowing them to tailor products and marketing more effectively.

Route-to-market implications for brands

The disruptions reshaping China's retail landscape are also upending traditional distribution. Distributors and wholesalers are losing importance as retailers and consumers gain power. Standardized products and in-store promotions no longer drive growth. Instead, brands now rely on 3PLs or logistics-focused distributors—partners that aren't tied to specific brands—to deliver to retailers not served directly.

Some distributors will have to evolve or exit the market as new ones emerge. High-control, "go-deep" RTM models will struggle economically as the traditional trade outlets lose traffic, and many could shut down.

The new RTM model must embrace new channels and understand how each operates. Many now require direct delivery and differentiated SKUs.

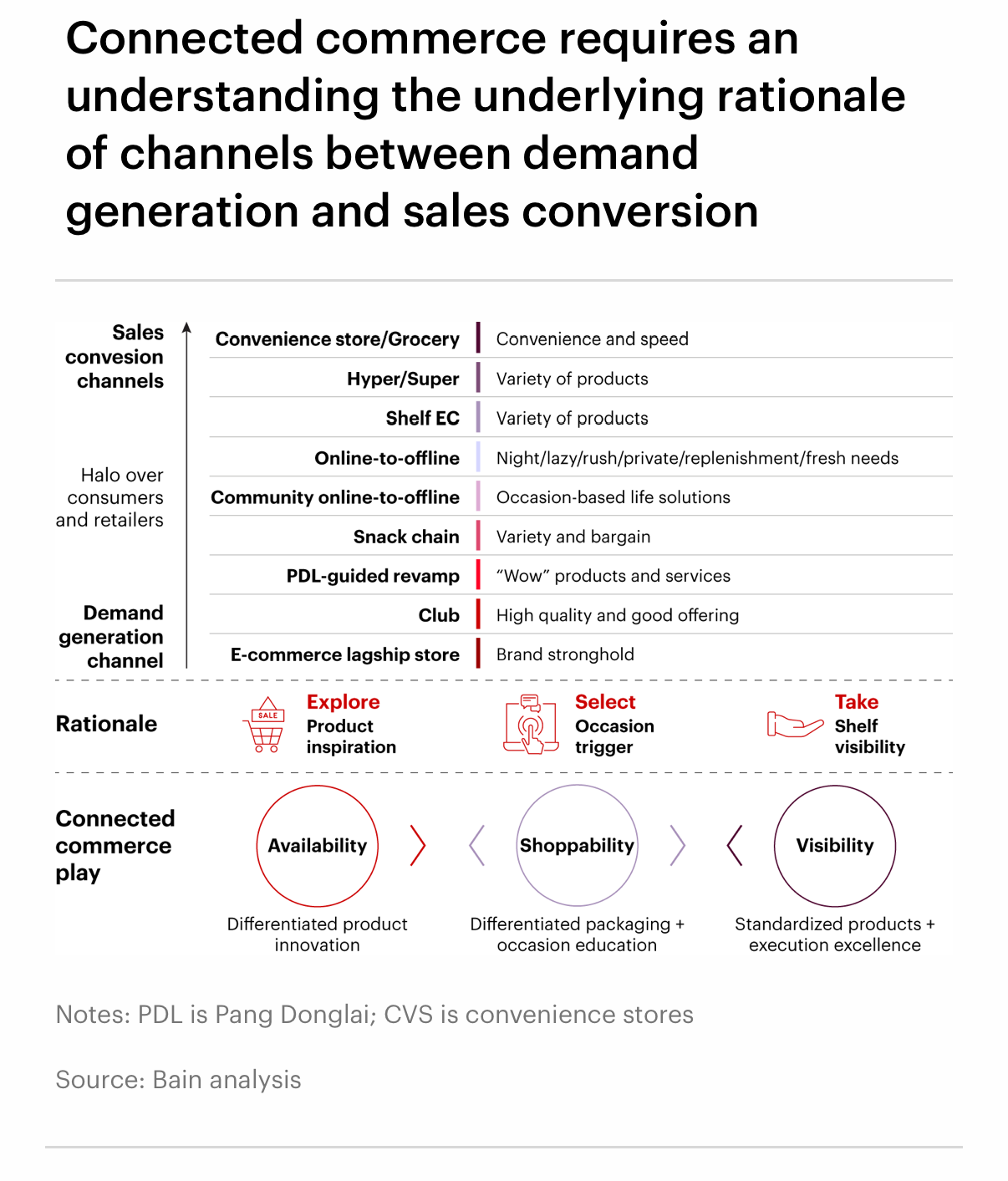

The framework below outlines each channel's role and the product types best suited to it (see Figure 5).

•Demand generation channels: Require distinct product innovation, often guided by retailers using their consumer insights.

•O2O channels: Call for occasion-specific packaging and targeted

education around those occasions.

•Traditional channels: Still depend on standardized products and

execution.

By engaging in "seeding"—building awareness and preference—through demand generation channels (势能渠道), consumer goods companies can influence consumers and retailer behavior across markets. They convert that influence into sales through sales conversion channels (动能渠道).

These two channel types operate on three core behaviors: exploring, selecting, and taking.

•Exploring channels: Include brand flagship stores and membership stores. Consumers actively seek out new products here, so brands must use distinctive, innovative products to create excitement.

•Selecting channels: Cover community omnichannel platforms and O2O services. Here, consumers choose products for specific occasions—such as meals throughout the day—so brands need occasion-based marketing. For instance, Hema's passion fruit iced cup paired with craft whole wheat beer captures the "small moments of happiness" after work.

•Taking channels: Cover quick-stop formats like convenience stores, where the

average visit lasts less than two minutes. Brands must ensure product

accessibility through shelf design, supported by strong in-store execution of

standardized products.

Ultimately, RTM transformation must be holistic and digitally enabled, as exemplified by DongPeng's (东鹏) RTM model. It aggregates full-cycle data (product flow, sales, inventory) by scanning QR codes on case exteriors, interiors, and bottle caps. By linking QR codes, it empowers internal and external stakeholders to collaboratively use consumer data for precise marketing, optimizing the supply chain via stock transparency and boosting sales efficiency with digital tools. This approach—which spurred DongPeng's gross merchandise volume to more than double-digit growth amid millions of scanning consumers—aligns seamlessly with the new CORE growth model for Chinese brands.

Overall implications for brand growth: the new CORE brand growth model

Brands must not only rethink their RTM strategies but also re-examine their entire growth model. If they don't, they risk losing relevance to more digitally capable and AI-forward retailers and savvier consumers.

The new CORE brand growth model is a proven approach that helps brands navigate this ever-evolving consumer and retail environment (see Figure 6).

Figure 6

C — Circumstances: Understand the when, where, and why that trigger demand

Brands should use both big and small data to identify real consumer needs, occasions, and channel trends that trigger emotional, social, or functional demand for target consumers. This means moving beyond traditional segmentation to deep insights via a consumer demand map that recognizes occasion-based need variations. Brands must grasp channels' rationales between demand generation and sales conversion, as well as their links to prioritized occasions. With AI and big data, retailers now dictate specific product needs for differentiation, so brands must prioritize occasions with highest potential and success likelihood.

O — Offerings: Deliver the total solution that builds brands

Based on consumer needs, occasions, and channel dynamics, brands must redefine category boundaries by first clarifying competitors "competing for the same job" to stand out in crowded markets. From this, they create offerings that integrate brand, product, pack, price, and experience to meet those needs. Every offering should solve a consumer's job-to-be-done in the circumstance. Beyond functional value, brands need to deliver emotional resonance via immersive experiences and gradually shape brand salience in consumers' minds through relevant messages and touchpoints.

R — Route to Consumer: Design a channel strategy that engages consumers/shoppers

When designing the channel strategy, brands should take two core dimensions into consideration: channel type (demand generation vs. sales conversion) and consumer behavior (exploring, selecting, taking). This ensures offerings are visible, accessible, and relevant where consumers naturally see, engage, and buy. Brands should treat route to consumer as the bridge between brand and audience, optimize fulfillment across channels, replace outdated distributor-dependent models, and align with retail's evolving landscape to maintain connectivity and responsiveness to consumer journeys.

E — Execution: Execute with fit-for-occasion packs and prices

It's important to deliver offerings via the right pack, price, and promotion at the right time and place. Brands must break down silos between marketing, sales, and trade marketing to form agile groups. They must also leverage digital tools for inventory transparency and data-driven precision to avoid inefficiencies. Execution turns strategy into reality, drives scalable conversion, and requires iterative test-and-learn adjustments to adapt to market shifts, all while leaning on digital enablement to ensure consistency across every touchpoint.

•The model's success also depends on AI and digital enablement across all components of the business model. Specific actions include:

•Leveraging consumer scanning data combined with CRM systems to analyze consumer profiles and needs.

•Defining the next wave of innovations.

•Enabling precise occasion-based marketing and boosting sales offtake.

•Using digital technology to enhance inventory data transparency, which supports more efficient supply chain turnover.

•Developing AI-powered digital RTM tools for sales teams and distributors, helping optimize RTM efficiency.

A test-and-learn approach is essential before scaling the full end-to-end brand growth model. This will allow brand teams to make adjustments based on real feedback from consumers and retailers. As a consequence, brands should shift from a siloed management model—where the marketing department handles marketing and the sales department manages sales—to a workflow that establishes agile cross-function collaboration between marketing, sales, and trade marketing. This will allow them to develop and execute this new CORE brand growth model and results-oriented action plans by connecting the dots from consumers to media touchpoints to stores, breaking down internal barriers, and forming a closed feedback loop for continuous improvement of the model and better results with consumers and retailers.

Today's O2O and food delivery wars are a starting point; even if platforms' subsidies are less generous in the future, tremendous changes will take place in China's consumer and channel ecosystem in the future. For brands, seizing occasion-driven growth based on CORE will be their new starting point.

The authors would like to extend their gratitude to the following individuals for their valuable contributions to this brief: Carrie Zhang, Weiwen Han, Siwei Shen, Kyle Tang, Ranqi Liu, and Yvonne Feng.

微博

微博 微信

微信