Authors:Michael Heric, Kurt Grichel, Sabine Atieh

Many finance organizations have spent the past few years becoming more valued business partners. The disruption created by the coronavirus will test how much progress CFOs and their teams have really made.

Powerful forces—including globalization, regulatory change, activist investors, automation technologies and scarcity of talent—have pressed finance teams to evolve. In response, many have sought to spend more time on higher-value, forward-looking activities, such as decision support, and less time on accounting and transactional finance activities. COVID-19 will demand not only that finance teams devote more time to value-added activities, but also that traditional activities, such as receivables and payables, run more efficiently and effectively, through remote collaboration and other new ways of working.

We suggest the following tactics for CFOs and their teams.

Raise the game on business partnering

For example, finance groups that have already gone through a zero-based budgeting program can apply that discipline to the top and bottom lines. Most urgently, finance should adjust management reporting to home in on the metrics that matter most right now. Leading indicators like new orders will be far more important than lagging indicators. In the most disrupted industries, the crisis may warrant creation of war rooms, led by business leaders and supported by finance, to provide daily or weekly updates on financial performance.

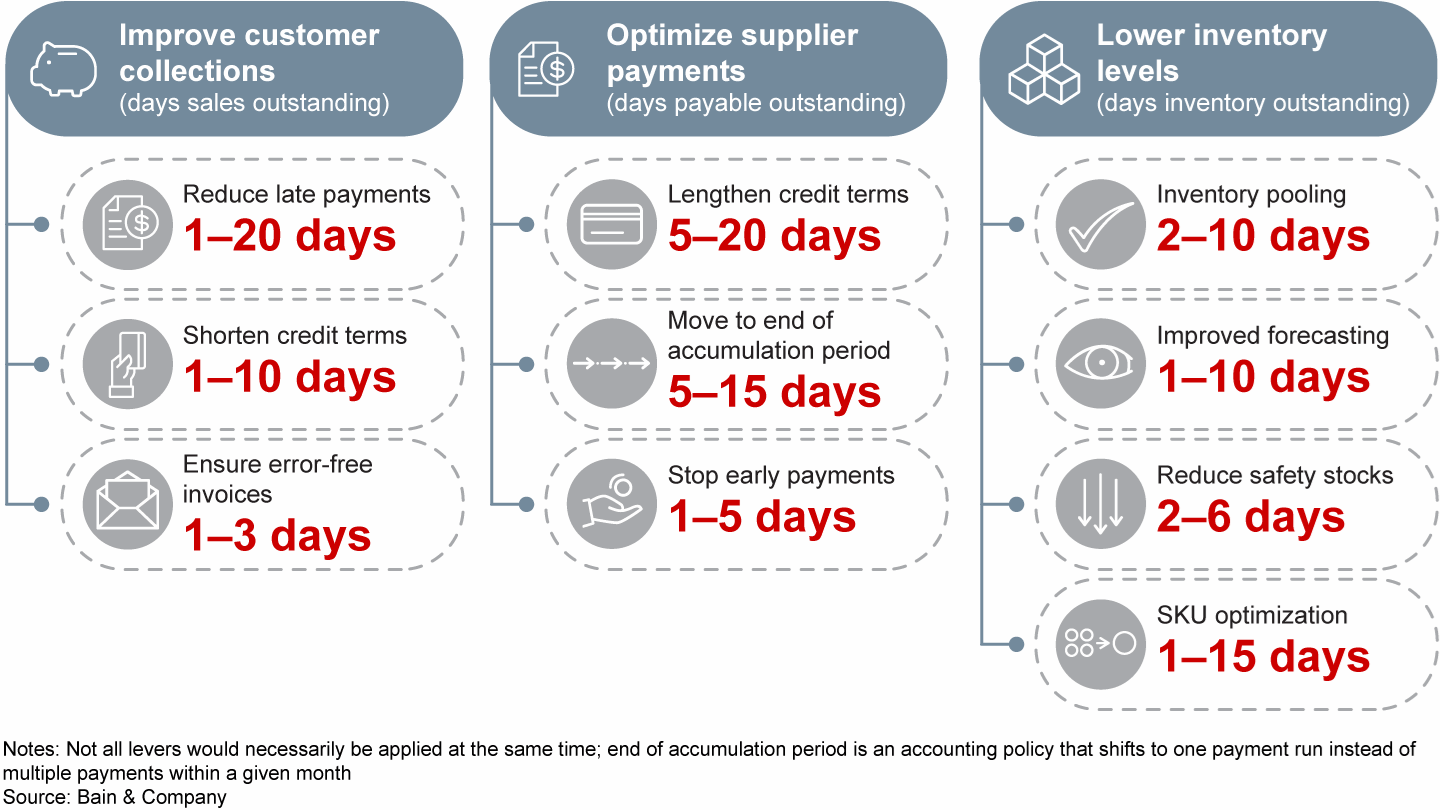

Protect the cash position and liquidity

Figure 1

Cash flow management now takes a critical role

Finance can also work with business leaders to revisit capital investment plans. Treasury should test funding sources for resiliency, then diversify contingent sources. Treasury may also need to prepare to renegotiate short-term debt to reduce the pressure on cash.

Activate or build contingency plans

Caterpillar, for instance, launched a trough planning initiative several years prior to the last recession as part of its 2005 strategic plan. Once the recession started, that planning allowed the company to take rapid, bold steps to align the cost structure with lower volumes and revenue. When revenue declined by 37% in 2009, Caterpillar had already started to execute contingency plans the year before, reducing selling, general and administrative costs by 17%.

For finance teams that have prepared contingency plans for a recession, FP&A could work with the business units to activate these plans now. Teams that haven't prepared contingency plans should align with the businesses on the steps and trade-offs required to manage through COVID-19. These plans may require cutting costs, variabilizing the cost structure, finding new revenue sources, shifting to more stable products or markets, or some combination of these actions.

Calibrate the right cadence of communications with investors

Avoid disruptions through business continuity planning

Take payroll: Some hourly workers may still receive paper checks from a print center, so finance will need alternatives to ensure that workers get their checks. In collections, companies may need to rapidly deploy virtual call-center solutions to route and resolve customer calls.

Plan for hits to the full ecosystem

Seize the opportunity to repair broken processes

Although the near-term goal is to ensure that finance provides the required support to the business, don't pass up the chance to take stock of where process redesign or simplification would yield big returns once the environment stabilizes.

Michael Heric, Kurt Grichel and Sabine Atieh are partners with Bain & Company's Performance Improvement practice. They are based, respectively, in New York, Seattle and Paris.

微博

微博 微信

微信